General

Although a lot of the mature markets still show a growth in the numbers of pets, especially some Asian markets, Brazil and Turkey are showing the strongest growth. What is the reason of that? And of course what are the main trends today and to expected?

The strong growth in these countries is in line with an increase in disposable income as well as a shift in attitude towards pets. While they used to be regarded primarily as working animals, their popularity as companions has increased considerably, in particular in urban areas.

In China, the popularity of pets was furthermore positively impacted by the government's "singlechild" policy, which resulted in pets becoming valued companions in the small nuclear family household. China in fact recorded the strongest rise in the total pet population in actual terms; nearly 40 million.

Thailand, while not a key market in terms of total number of pets, was clearly the growth leader. Over the survey period, the pet population in the country nearly doubled, to reach over 14 million in 2002, as a result of which Thailand became the fifth largest counter in Asia-pacific in terms of pet population.

Brazil boasts the second largest dog population in the world, surpassed only by the US. Brazilians are very fond of dogs due to their sociable nature. In rural areas they furthermore serve as guard dogs, in particular among upper-income households.

Urbanization – over 80% of the Brazilian population live in urban areas – led furthermore to growing popularity of smaller breeds. Urbanization and the increasing number of single-person households, however, also led to a gradual shift in popularity towards easier-to-care-for pets such as cats, birds or small mammals, as a result of which year-on-year growth of the dog population slowed down during the 1998-2002 period.

The Asian market

Number of dogs and cats

In China cats are by far more popular than dogs. Cats are favored in particular among the large number of older people due to the fact that they are considered more docile and easier to control than dogs. The fact that keeping a dog in China is also relatively costly due to high registration fees, coupled with the fact that the Chinese government imposes restriction on dog ownership, also had a positive impact on the popularity of cats.

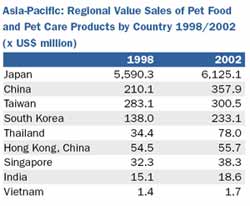

Pet Food and Care developments

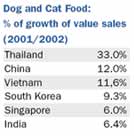

Thailand, China and South Korea showed very strong growth in the turnover of the prepared industrial food. The reason of this increase is due to a few main developments:

- rising disposable incomes led to rising consumption levels of prepared industrial pet food;

- consumer education on pet nutrition;

- improving retail infrastructures also had a positive effect on sales, both in volume as well as value terms.

In these three countries, demand for pet care products also rapidly increased, driven by increasing popularity of grooming products as well as toys, indicating that pet "humanization" is also increasingly evident in these emerging markets.

In India, while sales rose, the market remains in comparison underdeveloped. Total value sales in the country were less than US$19 million in 2002. While India has one of the highest human population figures in the world, the number of pets in the country is disproportionately small. The concept of keeping pets is clearly not as developed in India as it is in other countries of Asia-Pacific. Furthermore, although the pet population is rising in the country, they continue to be fed largely non-prepared food. Only 10% of the country's dog population is currently fed industrially prepared food, and cats are not fed prepared food at all.

Importance of the various sectors is widely different across Asia-Pacific. While dog and cat food plays a dominant role in Hong Kong, the Philippines and Thailand, it is far less important in Vietnam. Conversely, other pet food is barely existent in China and India, but plays the most important role in Vietnam. Similarly, pet care products are fairly well established in China and South Korea, but demand for such products is virtually nonexistent in Indonesia. The pet products market is thus far less homogeneous in Asia-Pacific as it is in more mature regions such as Western Europe, where sector breakdowns are very similar across countries.

All sectors showed strong growth throughout the review period in most countries - with the notable exception of the mature Japanese market, where sales slowed down across sectors in 2002. The fact that all sectors showed strong growth across most of the region also indicates that the whole pet products market is still in its early stages of development in most countries with the exception of Japan.

|  |

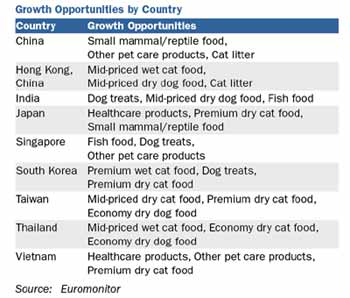

Future High Potential Sectors

In emerging markets, most sub-sectors are expected to grow strongly. In China, small mammals are also expected to become increasingly popular, thus driving growth of other pet food.

Other pet care products, already bigger than dog or cat food, is also forecast to perform strongly, as Chinese pet owners are also increasingly willing to spend money on non-essential items to "pamper" their pets.

With regards to dog and cat food, all price platforms are expected to record strong growth, as growth in emerging markets is not driven by consumers trading up to premium varieties, but primarily by pet owners switching from non-prepa-red to prepared food. Dry products will continue to dominate, although it can be expected that wet food will also record growth due to its premium status, which attracts consumers from affluent income groups. Demand for cat litter, still fairly underdeveloped in most developing markets, is also expected to increase, as a result of urbanization as well as rising disposable incomes.

Source: PETS International Magazine

HOME - About PetsGlobal.com - Pet Industry Links - Update my company - Contact PetsGlobal.com

© 2001-2025 PetsGlobal.com All right reserved