The market for dog and cat food accounted for €31 billion in 2003 according to new research by global market analyst, Euromonitor. Private label contributed to 10% of this revenue, which is a stable market performance in line with previous years. This lack of growth within private label suggests multiple grocers are experiencing diffi culties in increasing their share of the market. So what are the major challenges for private label in pet food? Is communication well targeted enough? What is the future of private label in the pet food market?

The context

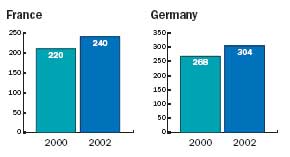

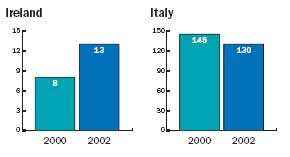

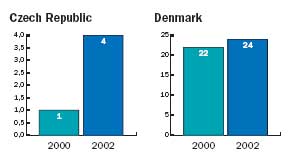

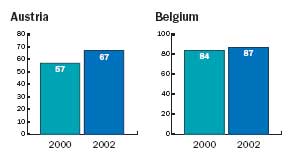

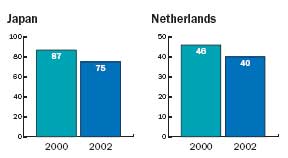

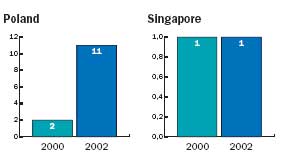

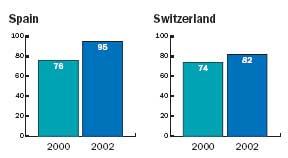

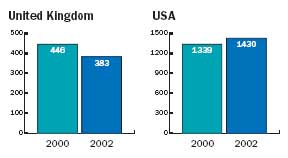

Private label is well-established in developed markets. Its presence is derived from multiple grocers', who are the owners of private label (for exaple a brand exclusively found throughout one chain of multiple grocers and not another). Private label is now also found in developing countries where multiple grocers are investing increasingly, such as Hungary and Poland with €6 million and €11 million respectively in 2003. The idea of private label is to offer consumers a cheaper alternative to branded products, with a comparable level of quality. In this context, Euromonitor found that Austria had the largest penetration rate for pet food private label in 2002, where it made up nearly a third of retail sales. Belgium, Switzerland, Portugal, Denmark, Germany, the UK and many more developed countries, including France, also all enjoyed double digit shares in 2002. In the US, the largest pet food market in the world, private label accounted for just over one tenth of the retail sales.

The dilemma

Multiple grocers like any other company, aim to generate profi ts by selling both their own brands (for example private label) and branded products (for example: Nestlé's, Mars', Procter & Gamble's, etc). On one hand, the presence of private label tends to decrease retail value sales, for private label is cheaper than branded products. On the other hand, retail volumes are much larger from private label sales than from branded products. The objective for multiple grocers is therefore to fi nd the right equilibrium between value (profi ts) and volume sales (economy of scale).

The market trend

Euromonitor had found that the pet food market has been experiencing a trend toward premium and superpremium products. This stems from the fact that pet owners literally treat their companion as a member of the family (or even sometimes as a partner, in the case of single households) and as such, expenditure on pet food is rising. The trends towards premium products has also been the result of extremely effi cient communication by manufacturers about the benefi ts of prepared pet food and this contributed to the development of branded products fi rst, then private label.

But premium and super premium pet food is largely found in pet specialists and pet superstores where private label is not as strongly present; although Pet's Home in the UK is planning to launch its own brand in 2004. And this is the major reason for the stagnation of private label in developed countries - the lack of private label in specialists.

Multiple grocers' brands perform well within economy and mid-priced products where value shares are lower in comparison to premium and super-premium products.

The response to the market

In order to benefi t from the market trend and also generate higher profi ts, multiple grocers, in the UK for example, have been focusing on "premium private label" products. While their shelves are still stocked with "standard private label" and branded products, they have also added in recent times premium private label products. This has not yet overcome the preference by many pet owners to purchase premium and/or super-premium (branded) products from pet specialists, but it has caused improvements in terms of revenues for multiple grocers. They have managed to attract a consumer group towards their premium private label and this in itself is an achievement. Having said that, manufacturers of branded products are nevertheless a length ahead of retailers in terms of premium products, thanks to effi cient new product development and innovation (eg product texture, life stage, etc).

Market position

Private label has made signifi cant improvements in terms of communication and quality. It has moved from having an image of low quality to one of being a premium alternative to branded products in countries such as Spain or France. Quality is always a subjective concept, even more so for pet food. But in a growing market, a stable market share is synonymous of higher revenues and as such, the future of pet food private label is bright.

Euromonitor celebrated 30 years in the research and business publishing fi eld in 2002, and is the world's leading provider of global consumer market intelligence. The company has offi ces in London, Chicago and Singapore, employing over 250 staff, of whom nearly 200 are full-time researchers. It also has a worldwide network of 600 market analysts, researchers and consultants. For more information Euromonitor's products and services please email to: chris.wetherall@euromonitor.com

Source: PETS International Magazine

HOME - About PetsGlobal.com - Pet Industry Links - Update my company - Contact PetsGlobal.com

© 2001-2025 PetsGlobal.com All right reserved