The Baltic States

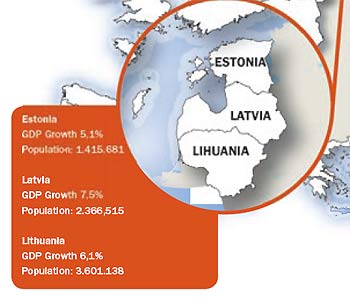

Throughout 13 years of independence, the Baltic States have managed to achieve a surprising amount including economic growth higher than, for instance, that experienced in Poland – 3,5 per cent in Lithuania, 5 per cent in Latvia and Estonia. As far as use of the Internet is concerned, Estonians rate even higher than some EU countries. A similar picture is seen with telephones, which are used by over half of the citizens of Estonia. The unemployment in those states amounts to 12 per cent (in Poland – 18 per cent, in EU – approximately 7.5 per cent).

Most of the well-educated inhabitants of the Baltic States gross from 800 to 1200 dollars, while the average salary varies between 350 and 400 dollars.

The unusual upturn which occurred within only a decade is the result of diligence and persistency of these small states. The command of English among the Balts is better than that found among Poles (20 per cent). The language is spoken by 29 per cent of Estonians, 23 per cent of Latvians and 21 per cent of Lithuanians. In Vilnius it is easier to communicate in Polish or Russian, however Riga and Tallinn are the cities where English intermingles with the native language and Russian.

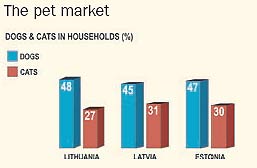

General tendencies on the pet market in the Baltic States

In each of these states the following tendencies may be observed as far as the pet market is concerned:

1. The pet products market is divided among the major retail centres: supermarkets, DIY shops, pet shops and veterinary pharmacies or shops at the veterinary surgeries.

2. Economically priced dog and cat food continues to constitute the main part of the market (Masterfood, Nestle, domestic manufacturers).

3. A signifi cant growth in sales and a growing interest in pet products, especially in Premium pet food, expensive accessories and exotic animals has been observed during the last two years. It is connected with the growth in prosperity and awareness of the citizens.

Supermarket vs Pet shop

Since Lithuania, Latvia and Estonia are small states, with a total of 7.3 million inhabitants, most of the trade and distribution take place in the major cities. Dogs and cats living in the country are not attractive enough as potential customers for the companies and sales representatives due to their owners'poverty.

The market of the Baltic States is dominated by the Lithuanian network VP Market (mainly Lithuania and Latvia, soon also northeast Poland) and the Maxima chain of supermarkets. In Estonia there are local chains and Scandinavian companies.

The supermarkets offer a wide range of economic dog and cat food (Masterfoods, Nestle, domestic and private brands), small animal food, fi sh food, reptile and bird food. There are more and more accessories, care products, snacks and treats for pets.

What makes people buy these products in supermarkets? The price of course. The same products as those produced by most international brands are 15-30 per cent more expensive in pet shops. For this reason, pet shops and veterinary pharmacies have turned to the more expensive, higher quality products.

The premium products and expensive accessories market is the domain of pet shops and veterinary surgeries. Pet shops, which at the same time are the distributors of Premium and Super Premium pet food, such as KIKA (pet shop chain in Lithuania), Hipika (veterinary pharmacies in Lithuania), Tropic, Komeks, Unison (Latvia) and Leigiv OU, Bramham Trade AS, Remedium AS from Estonia, represent a viable alternative to supermarkets offering high

quality products accompanied by reliable information and advice for the customer.

Domestic manufacturers

The group of domestic manufacturers in the Baltic States may be divided into several classes depending on the type of product.

Pet food, especially dog and cat food, is mainly handled by the companies directly or ndirectly connected with the meat and cereal industry.

These are mainly chicken-rearing and slaughtering companies which use slaughter by-products and, at the same time, supply the economic pet food market.

The quality of the products offered by these companies falls into the standard or economic class, however at the moment they already account for an important segment of the market.

In Lithuania there are companies that produce wet food, dry food and special snacks in the form of sausages. The situation is similar in Latvia – there are three dry food manufacturers and two dry dog snacks (dried ears, pig tails) manufacturers.

A separate group is composed of bird and small animal food manufacturers, who mix previously purchased grains, package them attractively, and deliver them to the shops.

The next group consists of lead, collar and other leather or textile pet products manufacturers. These are mainly former factories and tanneries dealing in leather processing which turned to a new segment of the market.

The quality of the products offered is very high and the price is considerably lower than that of the imported products. Many of these companies have established their position on the domestic market as well as in Euro-pean markets which were previously inaccessible.

Private Label

A very interesting aspect of the Baltic States pet market is private label, especially in the pet food sector. There are many different infl uences from other pet markets. This may be seen in particular in Lithuania in the super-markets.

The huge range of wet food from Polish manufactures such as Pupil foods or Ben is supplied to VP Market's Maxima stores under a private label brand. Many Polish manufacturers have also found a new market for bird and small animal foods in the Lithuanian market.

Dry private label pet food is supplied from companies in the Czech Republic, Germany, France, Holland and Poland as well and is then re-packaged.

The situation is different however in Latvia where there is more of a German and Scandinavian influence, and of course Russian. If a brand or product has achieved popularity in Russia, sooner or later it will also be very popular in Latvia as well. The reason for this is that more then 26% of the inhabitants of Latvia are Russian by origin. Estonia is a different story entirely; the pet food market is smaller and dominated by Scandinavian companies.

Conclusion

Pet food and the pet care market in Baltic States is certainly one of the most dynamic segments of the market, and will continue to grow rapidly in the next few years. The importance of private label will grow as a result of the low prices and wide range of products. The importance of premium and super premium products is also likely to increase as a result of growing customer aware-ness and changing lifestyles.

Inhabitants of the Baltic republics represent the best of the newest members of the European Union - small, but quickly moving towards becoming modern states. Aggres-sive and eager to do business. They are on the border of the united Europe, but this will not be an impoverished peripheral area, but instead may better be compared with an area such as the Benelux. These are the ambitions they have in the Baltics....

Source: PETS International Magazine

HOME - About PetsGlobal.com - Pet Industry Links - Update my company - Contact PetsGlobal.com

© 2001-2025 PetsGlobal.com All right reserved