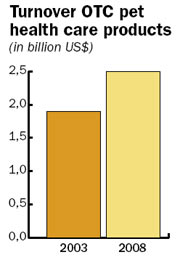

According to global market analyst Eurcmonitor, the world market for pat health care products reached US$1.9 billion in 2003, up 9% on the previous year. North America is the largest contributor with nearly 80% of the retail sales. Western Europe accounts for almost all other sales, with other regions of the world, such as Asia, experiencing only minor retail sales for pat healthcare products.

As pet owners continue to care more and more for their companion these days, companies throughout the pat industry have responded to this trend by offering a wide range of pat products which address all specific needs; from super premium pet food to cosmetics, such as shampoos and lotions.

A much larger market

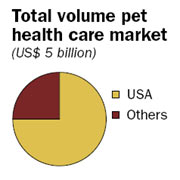

Euromonitor's research focuses solely on retail sales of over-the-counter pet healthcare products, as opposed to prescription based brands. If prescription products were included in Euromonitor's market sizes, the pat healthcare market would be worth about US$5 billion. with the US alone accounting for three quarters of that amount.

Prescription products include Heartguard, Sentinel, Interceptor, plus many more.

Food supplements in decline?

The sales of food supplements, which Euromonitor includes in pet healthcare, have experienced a slower than expected growth.

This largely stems from the fact that supplements have become more widely available in functional pet food, which means that pet owners do not need to buy supplements, as these have already been added to their pet's food.

For example, many functional pat foods now offer enhanced ingredient formulations, combining premium food with minerals, with the objective or addressing multiple healthcare needs. Addtionally, supplements have not performed well because pet owners do not find it very convenient to administer food supplements in a pill format to their household dog or cat and therefore, functional pet food offers a far simpler method.

Retail specialists

Veterinary clinics and other pet specialists dominate the distribution or pat healthcare products because advice from a professional is still required before sale. Most of the brands available in the market are close to the prescription market.

Furthermore, pet owners want to be certain their companion receives the best treatment available with the best options possible and in this context, pet specialists are the only choice.

Future outlook

Euromonitor is expecting retail sales or pat healthcare products to reach just over US$2.5 billion by 2008. Sales are likely to be fuelled by convenience and premium products.

Addtionally, the deregulation of prescription drugs will mean that more pet medicines will become available over-the-counter and this is also expected to contribute

to further sales growth.

One of the objectives of companies like Merial, already present in the UK, the US, France, Brazil, Canada, Germany and most developed countries, is to introduce super efficient brands into new countries such as China, where the market potential is simply enormous, as today, there are consumers in China with comparable purchasing power as westerners.

ABOUT EUROMONITOR

Euromonitor celebrated 3O years in the research and business publishing field in 20O2, and is the world's leading provider of global consumer market intelligence. The company has offices in London, Chicago and Singapore, employing over 250 staff, of whom nearly 200 are full-time researchers. It also has a worldwide network of 60O market analysts, researchers and consultants. For further information Euromonitor's products and services please

email to: chds.wetherall@euromonitor.com

The US pet health care market, humanisation or ...?

By Cerine van Winden

It is common knowledge that the human health care market is one that continues to experience growth. Due to the ageing of society, the expectation is that the human health care market will continue to increase in size. The developments witnessed in this segment first became visible in America.

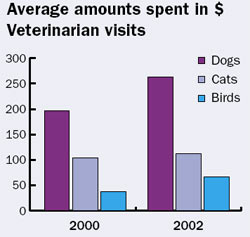

Thanks to the humanisation trend in the pat industry, the pat health care industry in America is a continually growing market. The growth of the pet health care market applies not only to the dog and cat segments, but to all of the pat segments. Moreover, spending has increased both in terms of visits to the veterinarian as well as for purchases of self-medication products. With approximately 65 million dogs and 78 million cats, it is no wonder that the American market is worth billions of dollars.

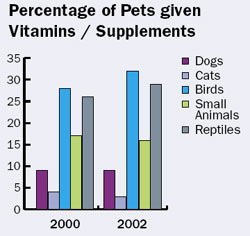

Like other markets, a large portion of the turnover in the American pat health care segment is also represented by amounts spent on flea and tick products. Where is the humanisation trend then? Does this trend even exist here? The turnover in vitamins and supplements does not indicate such a trend; on the contrary, it displays a slight downward turn.

Therefore, we may deduce that the humanisation trend in the pet health care segment may not be found in the use of vitamins and supplements.

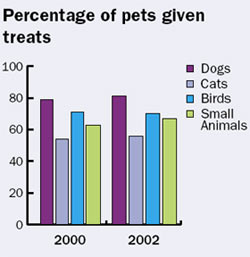

However, just as in the human market, the expression "a moment on the lips, a lifetime on the hips" also applies in the pat segment; the consumption of treats continues to rise in the pet market as well. It is also no great surprise that 16% of the dogs and 10% of the cats surfer from obesity and that many of these pets am placed on special diets on a regular basis.

Therefore one could say that on the one hand, people have started to take better care of their pets by going to the veterinarian in a timely manner, spending money on healthy food and the like, however, on the other hand, they cannot resist the temptation to also spoil their pets with snacks.

Source: PETS International Magazine

HOME - About PetsGlobal.com - Pet Industry Links - Update my company - Contact PetsGlobal.com

© 2001-2025 PetsGlobal.com All right reserved