The Market

The pet food market in Greece represents a fairly well developed product category, which continues to evolve in line with consumer demands and trends witnessed in other European countries. Pet owners here are no longer content to feed their domestic pets with table scraps and have been increasingly inclined in recent years to purchase industrially prepared pet food.

A further improvement of the prosperity is contributing to a further sophistication of the consumer demand, and dealers operating in this market have sought to satisfy market requirements by diversifying and offering a wider choice of product variants.

Data concerning the pet population in Greece is scarce, although the number of dogs and cats kept as domestic pets is now believed to be in excess of 1,000,000 and 900,000, respectively.

Pet Food Retailing

Grocery outlets such as supermarkets dominate the sale of pet food in Greece, and their importance in terms of total turnover is said to be increasing.

The recent boom in the development of international and national supermarket chains, coupled with the fact that these outlets are increasingly devoting more shelf space to pet food and pet care products, were the main reasons for the overall increase in value of sales via the supermarket/hypermarket channel. In 2002 it was estimated that 60% of sales were represented by large food stores (supermarkets).

The extended volume of brands now available in Greece means that larger stores are better equipped to deal with the increasing number of product variants, now often packed in larger sizes. In addition, increased advertising spending on high-profile brands encourages retailers to stock a greater variety of pet food items.

Specialist shops such as Mega pet stores, pet shops, kennels, breeders and veterinary clinics tend to stock more specialist varieties of pet food. In 2002, these types of outlets accounted for an estimated 40% of the total turnover.

Pet store chains have emerged over the last several years in the market, including Zoofilia, Pet City, Pet Champion and Zoo Planet.

Market Size and Structure

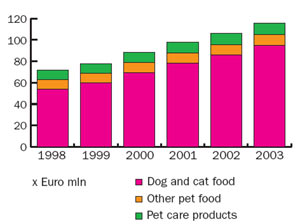

Consumption of industrially-prepared pet food reached an estimated 50,000 tonnes in 2002, representing a strong annual increase of 6% and an overall five-year expansion rate of 35%.

Dog and cat foods appear to account for almost 80% of the total value. The growth in this sector was fuelled by the growing number of households owning cats and dogs. Value growth in 2004 stems from a growing interest in satisfying dogs' and cats' needs and preferences in terms of nutrition, coupled with the fact that consumers have too little time to prepare dog and cat food at home.

In 2002, the volume of dog food sold reached 30,000 tones, with every year demonstrating a strong growth as well.

In cat food, the volume turnover reached 20,000 tones in 2002, representing an overall growth rate of 59% compared to the sales level reached in 1997.

Manufacturers & Brands

The supply structure is dominated by the two international giants, Nestle – Purina and Masterfoods. Information regarding manufacturer shares is scarce, however, it is estimated that between them, both companies represent approximately 40% of volume turnover.

The remaining turnover is represented in its majority by major international pet food players such as: Hills, Nutro, Eukanuba, Pro Pac, Nova, Techical etc.

Source: PETS International Magazine

HOME - About PetsGlobal.com - Pet Industry Links - Update my company - Contact PetsGlobal.com

© 2001-2025 PetsGlobal.com All right reserved